You may think you have plenty of time to complete and submit your FAFSA — after all, for any given school year, the deadline isn't until June of the following year. But students might miss out on A LOT of potential aid if they don't file soon. WSU and FAFSA.gov recommend filing ASAP after January 1st — and that means getting your taxes done ASAP too!!!

|

⇐ |

What About Me!?!?

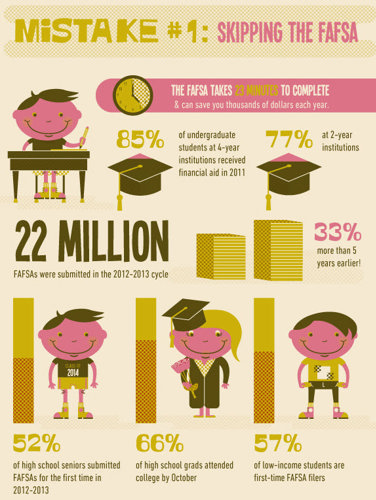

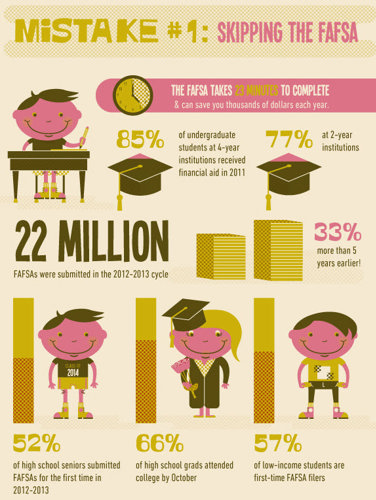

- Taking 23 minutes out of your day could save you thousands of dollars each year

- Just because you didn't receive aid one year DOES NOT mean you won't during you college career

- 85 ... percentage of undergraduate students at 4-year institutions who received financial aid in 2011

- 77% at 2-year institutions

- 22,000,000 ... # of FAFSAs submitted for the 2012-2013 school year ... 33% more than 5 years earlier

- 52 ... percentage of high school seniors who submitted FAFSAs for the first time in 2012-2013

- 66 ... percentage of high school graduates who attended college by October, 2012

- 57 ... percentage of low-income students who were first-time FAFSA filers

|

Ohh ... That Can Wait!

- PROCRASTINATION is a very bad habit to get into before/during your college career:

- School ... Feel stressed as DEADLINES APPROACH, quality of WORK GOES DOWN, etc.

- Financial Aid ... Miss out need based aid

- Deadlines for each academic year MAY range ANYWHERE from February 1st to 30 days after the term starts

- Majority of an institution's need-based aid, including WSU's, is awarded on a FIRST-COME, FIRST-SERVED basis; such awards include:

- Grants (federal, state, and institutional)

- Work-Study

- Loans

- Don't forget to complete your taxes: You NEED TO COMPLETE YOUR TAXES before completing the FAFSA, so get started on your taxes ASAP!

|

⇒ |

|

|

⇐ |

Why Work!?!?

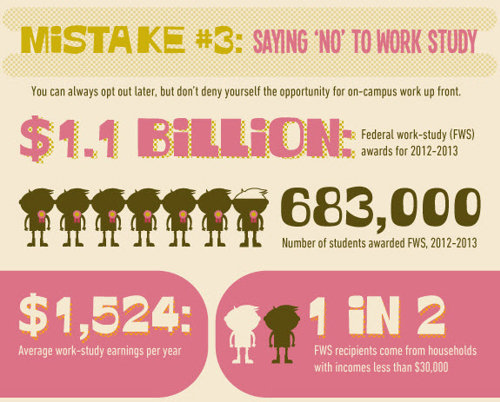

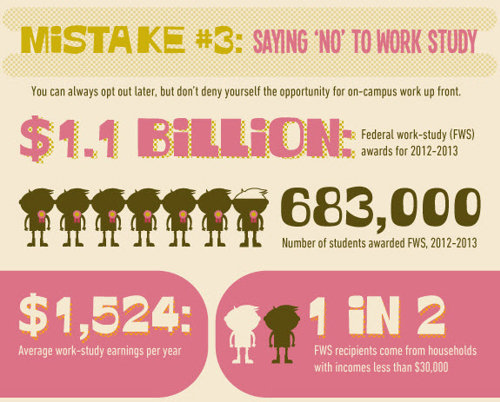

You can always decided to opt out later, but DO NOT DENY YOURSELF the opportunity to work on-campus up front.

- $1,100,000,000 ... Federal work-study awarded for 2012-2013

- 683,000 ... number of students awarded this same year

- $1,524 ... average work-study EARNINGS per year

- 1 iN 2 ... number of work-study recipients that come from households with income less than $30,000

|

DISCOUNT DOUBLE-CHECK!

- Make sure you are completing the right sections with the RIGHT answers

- Make sure to GET THESE RIGHT on your FAFSA:

- Household Size

- Social Security Number

- YOUR FULL LEGAL NAME as it appears on your government ID

- And remember, the FAFSA you fill out TODAY is for the UPCOMING SCHOOL YEAR

|

⇒ |

|

|

⇐ |

TMI!

- Reporting incorrect tax information can disqualify you from need-based aid

- DO NOT INCLUDE:

- Your AGI (Adjusted Gross Income), or your application will be rejected

- The FAFSA asks for a federal income tax figure from a specific line of the federal tax return

- Home equity from your primary residence

- Qualified retirement accounts in your nontaxable net worth of your investments, example:

- IRAs

- 401(K)s

- 403(B)s

- Pension Plans

|

Can I have Your Autograph?!?!

- Don't forget to SIGN YOUR APPLICATION (Yes! This actually happens)

- Common reasons a FAFSA lacks a signature:

- Parent is not present to sign his/her portion

- No FSA ID

- Forgotten FSA ID

** To avoid many of the most common FAFSA mistakes, use the IRS DATA RETRIEVAL TOOL to automatically transfer your tax information **

|

⇒ |

|